A home is a place of tranquility, where you can be your absolute self with your family. For most people, possessing a home is more than a necessity; it is an ambition. In the past, people were keen on building their homes from scratch; but the trend has now shifted to buying homes. The flourishing real estate industry is ideal for the current generation which cannot afford the time or hassle to construct their dream home. Apartments have become a symbol of convenience and signify an urban lifestyle. Homes are also significant investments, especially when buying them upfront. If you are planning to own an apartment, there are two options to choose from – the under-construction property and the ready-to-occupy property. Let us weigh the merits and demerits of both so that you can select the most effective option for your budget and time frame.

The cost factor

Buying a home involves considerable expenditure, so cost is the very first factor to be considered. Under construction homes are always priced at the lower end compared with ready to occupy properties because they are in the initial phase of construction and the realtor is looking for more investments. Also, properties under construction seem appealing since the total spending on the house is only about 30-40% of the price of ready to occupy apartments, making it a good entry level price point. You can opt for installment payment, which makes the load lighter for you. It is a great deal in terms of pricing, but you have to keep in mind the wait time, as well as the risk of EMI and rents during the long wait for the completion of the project.

Ready to occupy homes, on the other hand, are for buyers with substantial funds to make a bulk investment. Here, you can move in straight away by paying the cost. But there are more people on the lookout for these properties, making the prices climb.

Perks and additions

For under construction properties, you may get additional benefits and discounts since the construction is just underway and the realtor is ready to throw in perks to attract more investments. You can also choose a place with the best view and extra amenities within your price range. The same way, for ready to occupy homes, you have furnished apartments with amenities like rooftop gardens and pools in place as you move in. Under-construction properties do carry the risk of getting lower carpet area than the original plan, and this either causes area constrictions or renders amenities such as swimming pool, gym etc. non-existent. For ready to occupy apartments, you get what you see and there is no confusion regarding the same.

Tax savings

Purchasing a home involves a large chunk of money as tax, making taxes a pressing concern. Ready to occupy properties fare well in this scenario as they are exempted from the payment of 12% GST, while under construction properties are bound by GST. In addition to it, Section 80C of the Income Tax Act also deducts Rs1.5 lakhs from the principal for the purchase of ready to occupy properties, along with up to Rs. 2 lakh deduction on the interest. However, the catch here is that these have to be utilised within three years of investment or this provision will lapse. As construction delays are the new norm in the country, you may lose these benefits if you are not cautious.

Purpose

If you are currently occupying a rented property and looking to move out fast, it only makes sense to opt for the ready-to-occupy property since there are no delays in shifting. Construction completion, especially in India can take a painfully long time and can cost you more on rentals. Along with the risk of delays and project completion apprehensions, it can be quite frustrating. You can opt for under construction property if you are quite settled at the moment and are looking to shift to a new place in a couple of years.

Location

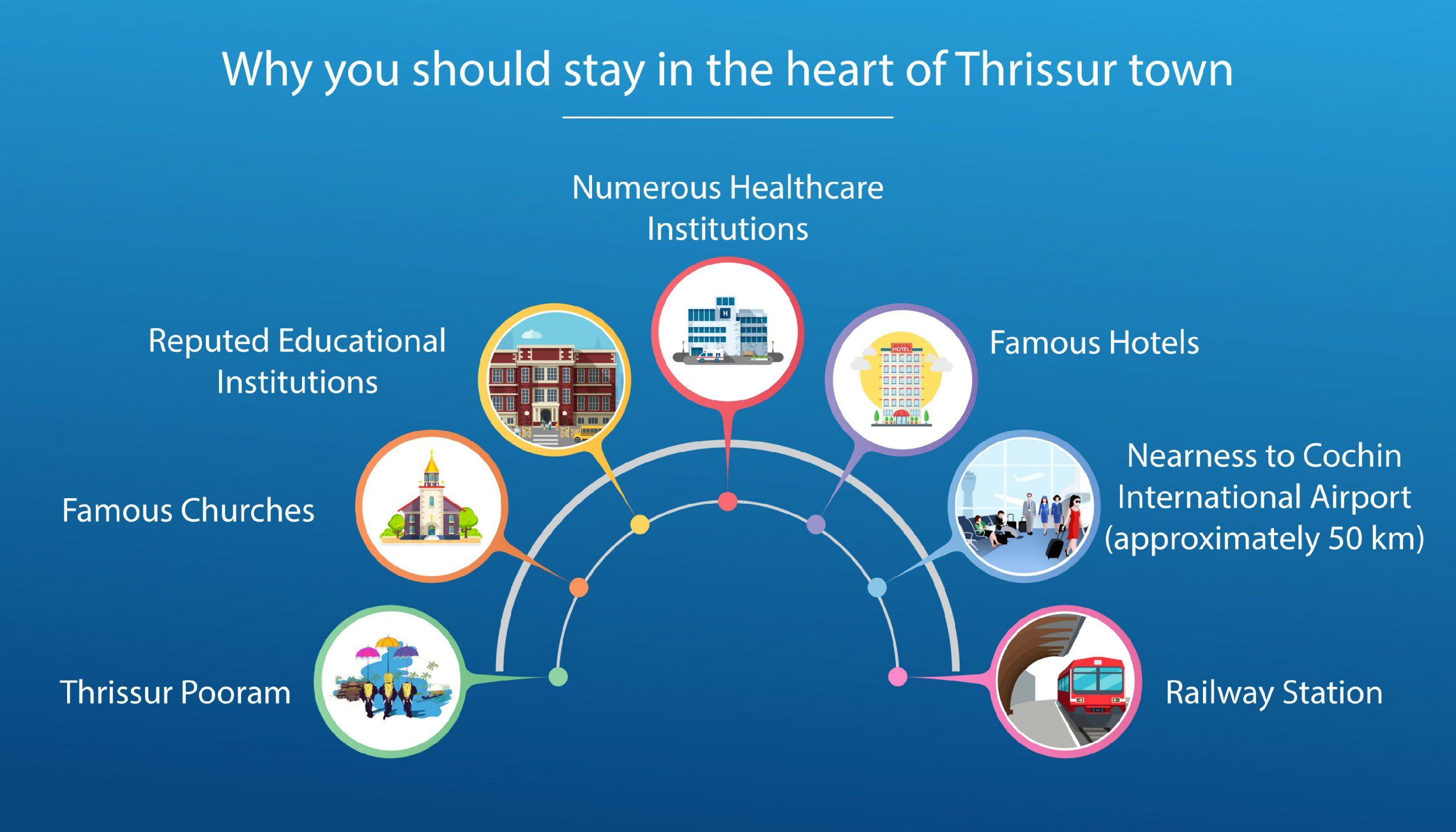

Another important criterion to consider is location; it greatly determines your convenience. If your property resides in a place that is currently developing, it is best to opt for under-construction homes because if you move in right away, you may get stranded by the lack of shops and transportation facilities. If the property is situated in a developed area, a ready to occupy place should be no concern as you have all necessary amenities in place. For developing regions, you get the bonus of capital appreciation by the time the project is complete, and your home will have a higher value.

RERA Compliance:

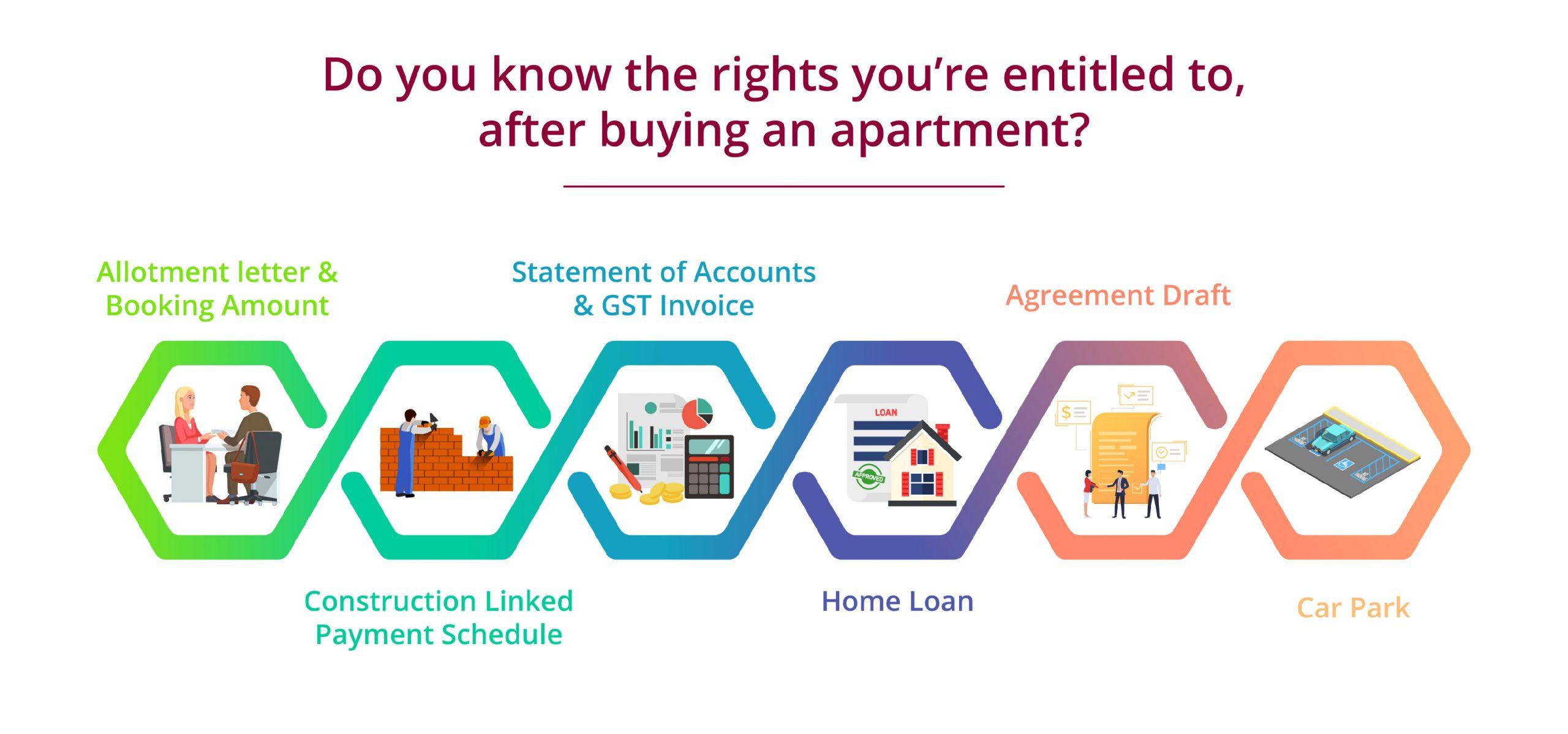

Since May 1, 2017, it is mandatory that any property possessing Occupation Certificate needs to abide by the RERA rules mandated by the state. It applies to under construction properties, which means construction has to follow fair trade practices. RERA is especially helpful to buyers since they can access information about different features in detail on the RERA website, and in case of issues, questions can be raised and grievances will be addressed by the Appellate Tribunal formed under RERA. This makes way for a speedy solution for problems faced by the byers without much hassle.

Customisation

Everyone prefers a touch of uniqueness to the homes they live in. Individuality is an unavoidable factor when it comes to homes and it is always preferred, even if at the smallest degree. This is one reason why people prefer properties under construction, because such properties have more vacant spaces that can be modified according to the tastes of the buyer. When it comes to properties under construction, you can plan your ideas accordingly and even work out the plan with your architect. Ready to occupy apartments do not provide much scope for customization compared to that, as the framework has been already laid and the furnishing has been done, but you can always add your own personal touches in the form of interior decor.

Before you settle on your choice, it is imperative that you speak with your realtor. It is important to clear all doubts so that you won’t be left in the dark later. If you still feel confused, you can always seek the assistance of trusted developers to guide you through the process.