Shifting to a new home can be exciting and tiring at the same time. Searching for a new place, finding the perfect house, setting it up from scratch, and bearing the expenses, everything can be overwhelming. Paying the rent and security deposit altogether can be hefty – even for salaried individuals. And the expenses might even double up, based on the location, especially if in a metropolitan city.

The amount for security deposit might be equal to 2 to even 11 months’ rent combined. So you will have to pay twice, thrice or even more of your per month rent at once. This amount should be expected as early as you decide to shift. Again this amount can even go up depending on the city, locality or the amenities that apartments have. These spends could be overburdening and can burn your financial stability as the funds would be required within a short period of time. Planning for a personal loan or any other such loan well in advance could be the one solution to avoid shifting woes and unnecessary delays.

This is precisely where cutting-edge loan products such as rental deposit loans come to your advantage. Apart from flexibility and better expense management, one of the advantages of such loans is convenience.

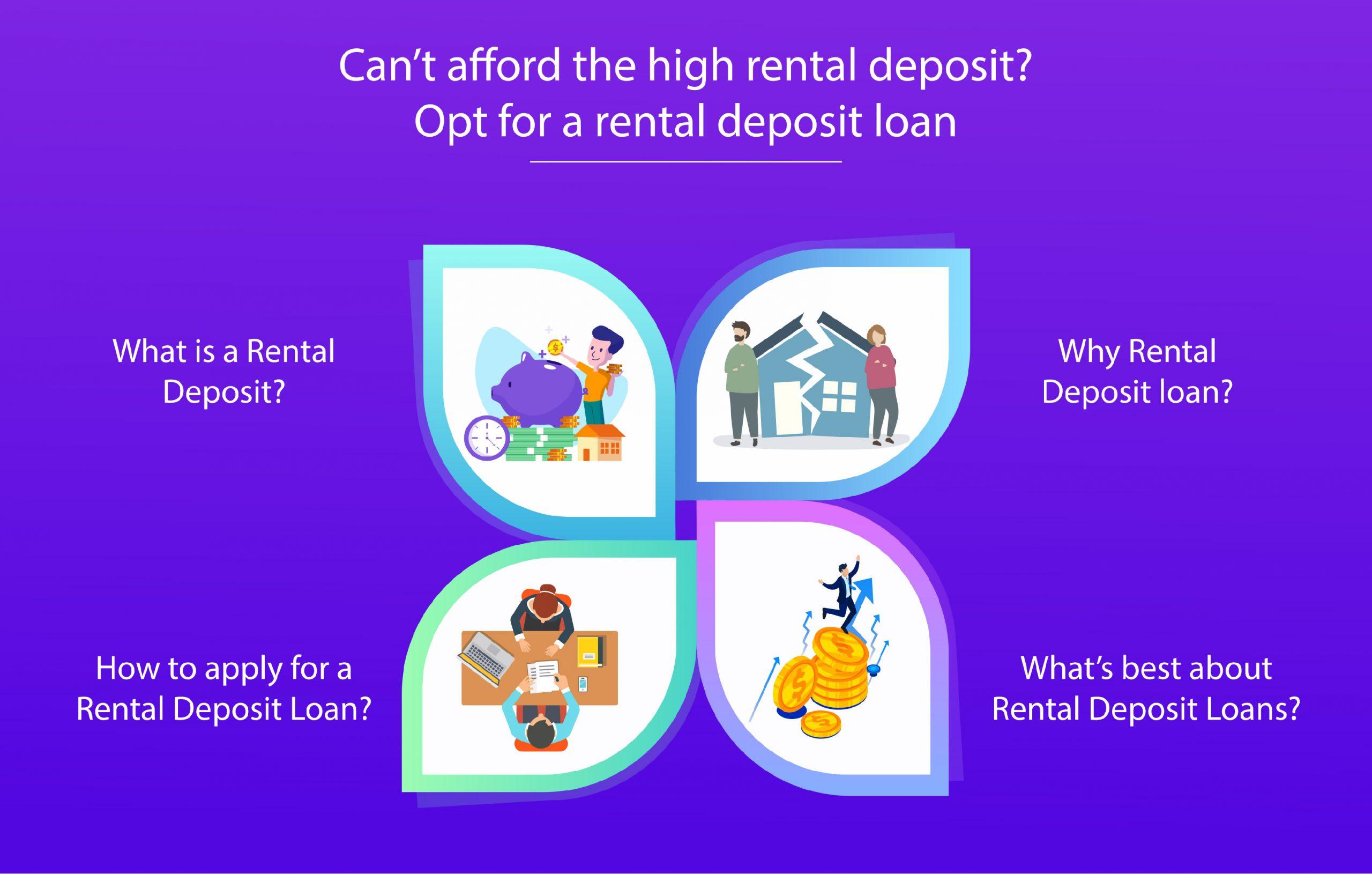

But first, what is a Rental Deposit?

When you rent an apartment, the landlord demands a certain amount as the rental security deposit. Usually, the security deposit is the sum total of 2 to 3 months’ rent and is used as a caution deposit to pay off the repairs for damages caused by the tenants to the property, if any, during their time of stay. When the renter moves out, and the rental apartment is in good condition without the need for repair, the security deposit will be refunded to him/her in full.

Why Rental Deposit loan?

Rental Deposit Loans are for those people who can’t afford hefty security deposits that they have to pay in order to rent a house. You can loan the required amount from a financial institution to pay the security deposit. The loan may start from 1 lakh and go up to 5 lakh at interest rates that vary from 1.5 to 3 per cent. The tenure of the loan can differ accordingly as 11, 22 or 33 months based on the rental agreement.

One of the ideal features of a rental deposit loan is that the tenant is liable to pay off the interest whereas the principal amount can be repaid when the landlord returns the security deposit.

In case, the tenant plans to extend his stay, then he/she can either inform the bank and submit a new agreement addressing the extension details and continue with the monthly interest payments on bank’s approval or close the loan by paying off the principal amount altogether.

How to apply for a Rental Deposit Loan?

- There are many leading rental service providers in the country like LoanTap or Paymatrix or you can directly approach the services of many reputed banks. You can even apply online through their respective websites.

- They may ask you to submit valid documents such as identity and employment proof, salary slips for 3 to 6 months, bank statement, a copy of the rental agreement.

- Although the eligibility criteria differ across the financial institutions, some of the norms are common. The applicant must earn a minimum of Rs.30,000 to Rs. 40,000, monthly to qualify for the loan. He / She must be an employee of a limited/private limited company or a government organisation.

- A processing fee will be charged which varies from 1.5% to 2% plus the taxes on the total loan amount.

- The borrower can pre-close the loan after 6 months. A minimal foreclosure charge is applicable on closing the loan within 6 months of disbursal.

What’s best about Rental Deposit Loans?

Rental Deposit Loans are the best way for one to manage his expenses. Especially if you’re moving to a completely new city, this can aid you well n saving your Savings from depleting. You might have a tonne of other expenses on your checklist to account for on renting a new apartment, therefore, paying off the security deposit with the help of a rental deposit loan will help you escape the financial burden. Such loans can help you achieve comfortable living in your dream apartment with ease.

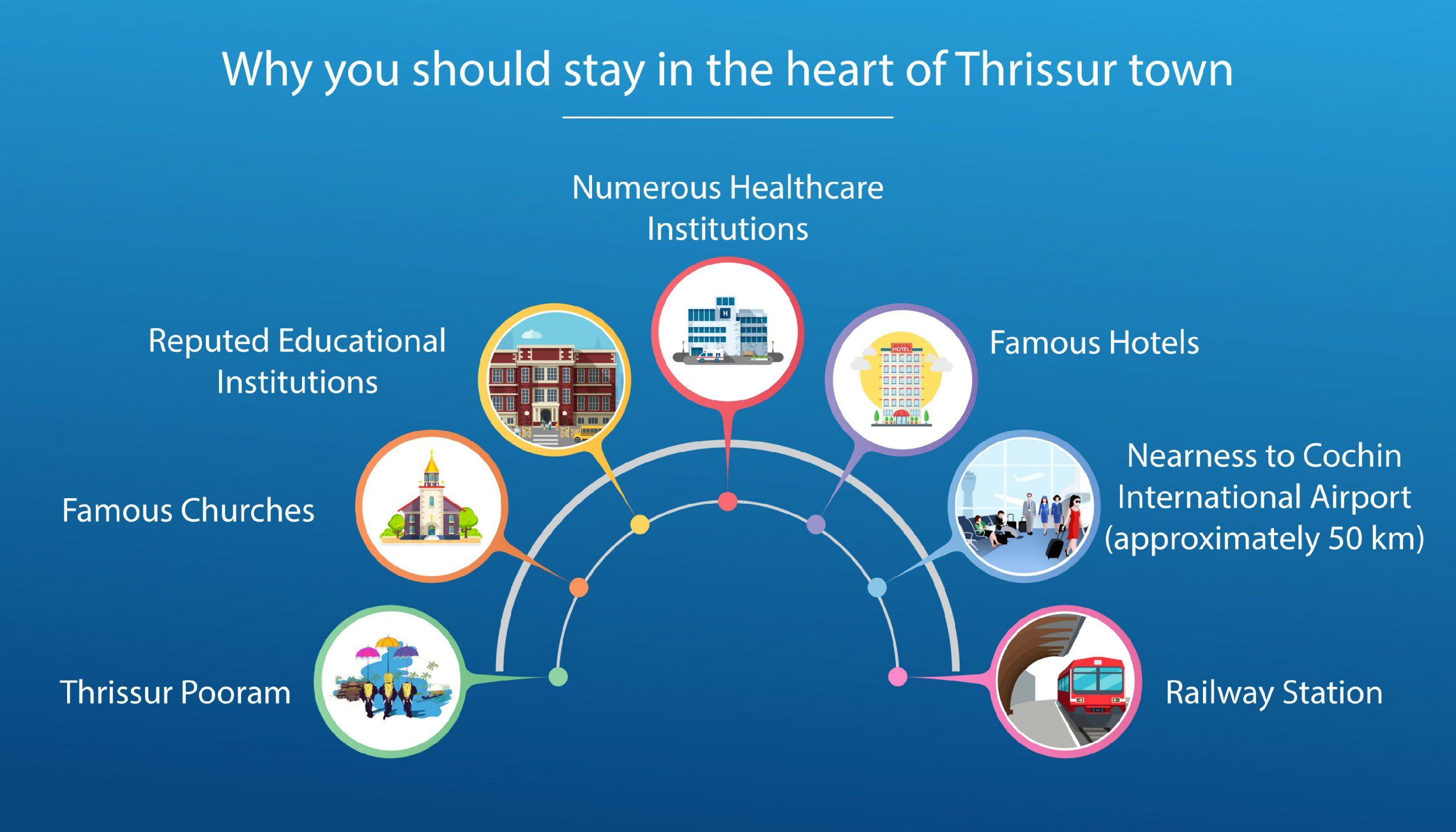

Rental Deposit Loans can help your way through hefty security deposits. Similarly what you need is a trusted partner when it comes to finding yourself the perfect home you deserve. That’s why we suggest you pair with Kalyan Developers, the best builders in kerala. With Kalyan Developers by your side, you’ll have an array of luxury apartments to choose from at prime locations in Kerala. So what are you still waiting for?