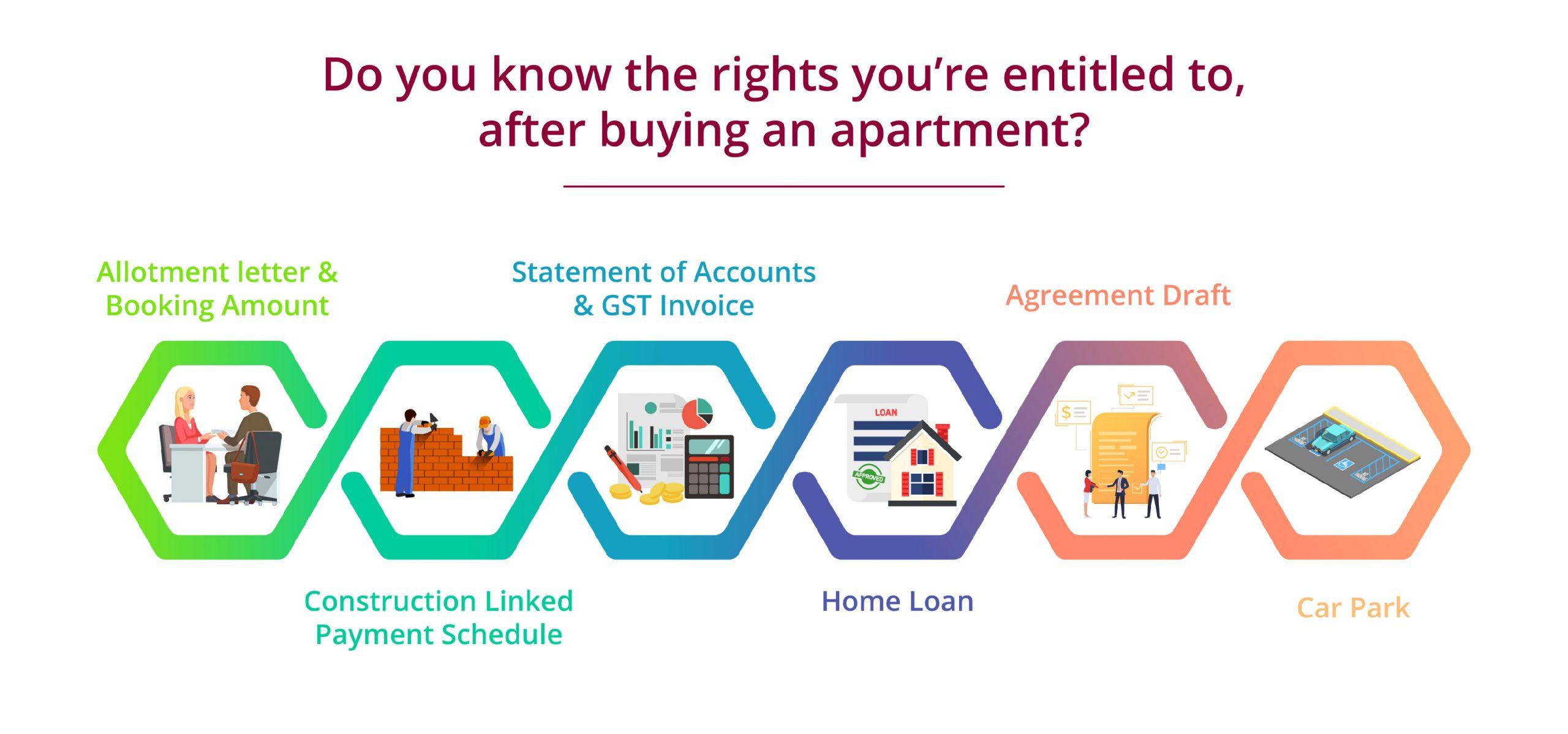

Owning an abode is a necessity and a desire that has to materialize at some point in the life of every human being. Moreover, it is a lifetime investment that has to be cherished forever. However, the entire process of finding the land and building a house can drain a considerable part of your precious […]

Read More >