ഇന്നത്തെ സാമൂഹ്യജീവിതത്തിലെ പ്രധാനകൂട്ടായ്്മകളില് ഒന്നാണ് അപ്പാര്ട്ട്മെന്റ് ഓണേഴ്സ് അസോസിയേഷന്. താമസക്കാരുടെ ക്ഷേമത്തിനായി നിമയാവലികളും മാര്ഗരേഖകളും ഉണ്ടാക്കുകയും

Read More >

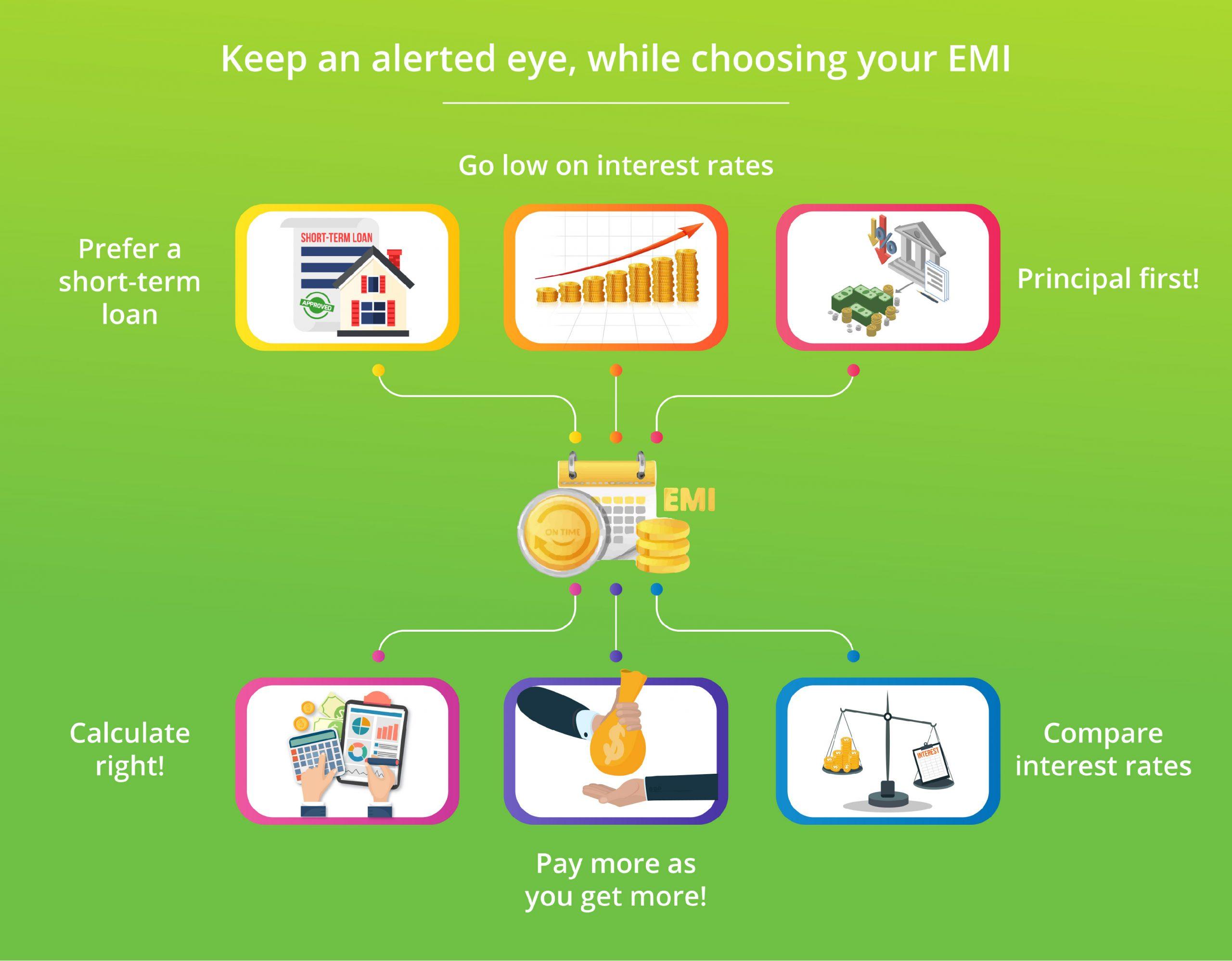

These days, when you decide to buy an apartment in Thrissur or a flat in Trivandrum, there aremany options that you may consider to finance your purchase. Since, buying a dream home inthe most prime location is usually an investment of a lifetime’s savings; many choose the optionof taking a home loan. While taking a home loan, it is important to be aware of the nuancesinvolved, especially with the monthly EMIs. It is extremely important to ensure that the EMI asper your scheme is within your budget and doesn’t leave you in a crunch for money everymonth. Most people consider EMIs as a financial burden and often make the mistake ofchoosing a long-term loan to pay lower EMIs. But at the end of it, they end up paying doublethe interest. A wise buyer, meticulously plans to make his home loan EMIs affordable.

The following are some important measures to consider while planning your EMI so that you areable to efficiently plan the purchase of your new home or apartment.

Forget the temporary ease of a long-term loan while buying a new home andchoose to opt for a short-term loan. A shorter term loan might require you to payhigher EMIs, but the overall interest paid at the end of the term will work out to beextremely profitable as compared to a long-term loan. This is because a short-term tenure will mean that the principal amount of your loan is paid faster whichleads to lower interest rate because interest is calculated on the outstandingprincipal amount.

Though you could be in a hurry to lock on a home loan to pay for your newapartment or a home, it is important to carefully choose a low interest home loan.You must also consider refinancing your home loan if the interest rate is comingdown.

A great tip to lower your burden is to pay the maximum principal amount so that itwill reduce the rate of interest to be paid to the bank. In case there is a part ofyour savings that you kept aside while planning to buy a new home or yourdream apartment, use that to pay a part of your principal amount and get yourprincipal amount reduced along with your interest!

It is extremely important to calculate your finances based on your monthly orannual income. This will help you pick the right EMI rate and will benefit you inmultiple ways.

As you climb up the ladder in your career and secure a higher salary with everypassing year, make sure to start paying a higher EMI amount to reduce thetenure for your home loan. It will surprise you when you find out how much of theinterest amount you are paying less. This will help you to finish paying your loanfaster with a much lowered interest rate.

Home loan borrowers need to approach the bank and enquire if they can reducethe interest rate of the existing home loans. Unless it is initiated by the customer,the banks will not do anything to reduce the interest rates. In case you are in a fixwhen banks don’t allow a reduced interest rate, it is important to find out lowerinterest rates offered by other banks and get your loan refinanced. You must alsofind out the charges for switching the loan to another bank before going aheadwith refinancing.

So, go ahead a find the perfect home loan with an affordable EMI to finance thepurchase of your new 2 or 3 BHK apartment in Kochi. It will be great to associatewith the most trusted builder in Kerala- Kalyan Developers to ensure trustedservices all through your journey towards a new home. Also, follow these quicktips to ensure that you choose the right EMI for your home loan so that you willnot realize the number of years that have passed in paying it and will seem muchlighter on your pocket! Your dream home in the best city in Kerala is just a ‘perfect EMI’ away!