ഇന്നത്തെ സാമൂഹ്യജീവിതത്തിലെ പ്രധാനകൂട്ടായ്്മകളില് ഒന്നാണ് അപ്പാര്ട്ട്മെന്റ് ഓണേഴ്സ് അസോസിയേഷന്. താമസക്കാരുടെ ക്ഷേമത്തിനായി നിമയാവലികളും മാര്ഗരേഖകളും ഉണ്ടാക്കുകയും

Read More >

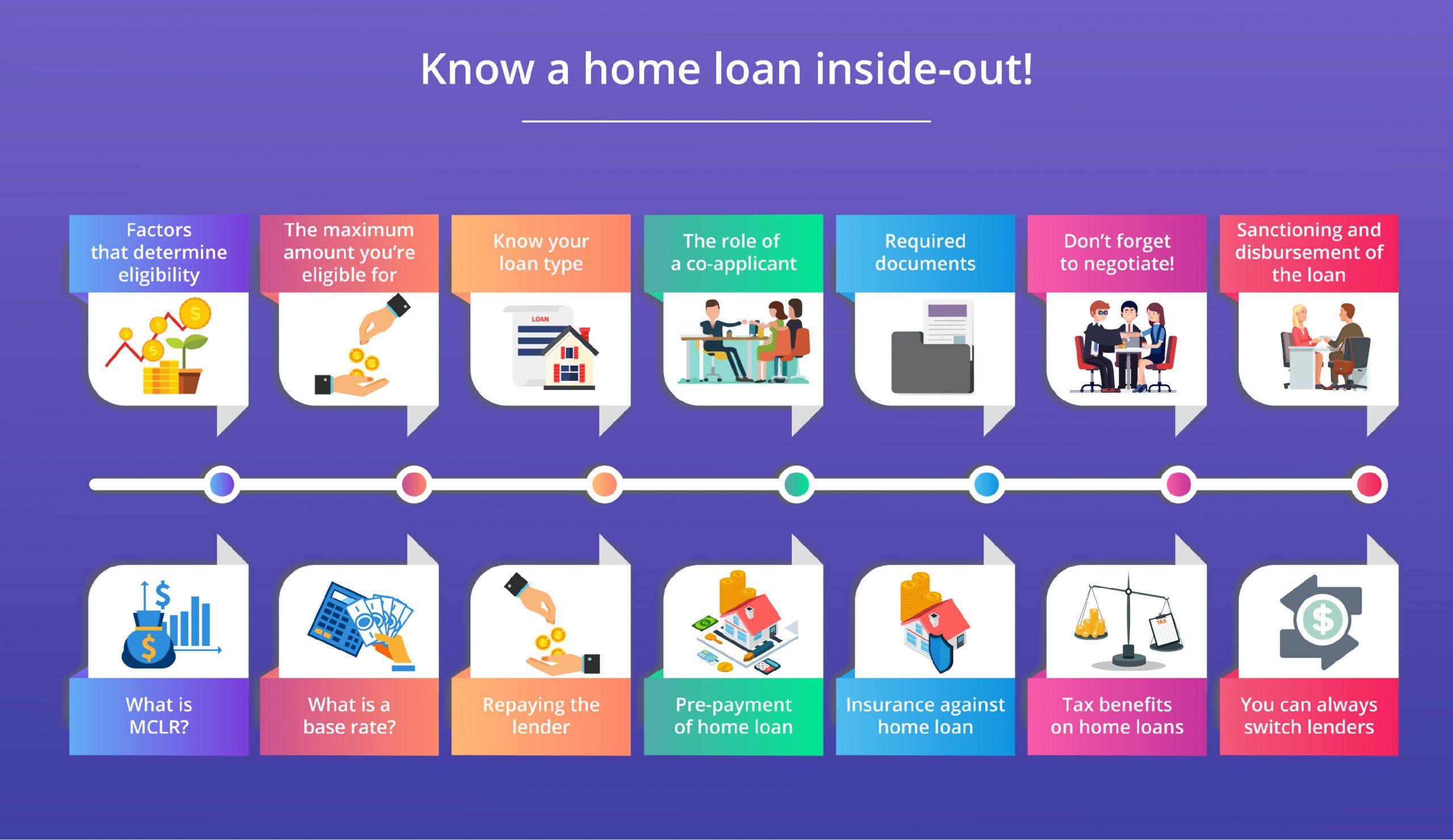

A home loan is sometimes the only answer to your quest for a dream home. However a home loan that’s not chosen wisely can be less of a boon. Like any other financial product, home loans that are chosen to buy an apartment or villa in your dream city needs to be learned carefully to avoid any sort of unpleasant surprises later. Also, it is important to know about the basic ways in which a home loan works and all the other necessary criteria before you sign the dotted line.

A better understanding of a home loan, will result in the smoother the experience of buying a new home.Listed below are some of the pointers to be strictly looked into, before signing up for one.

Factors that determine eligibility: The total eligibility for a home loan will solely depend on your repaying capacity. A person’s repaying capacity is based on one’s monthly disposable income which is determined based on factors like monthly expenses, spouse’s income, assets, other liabilities, stability of income, etc. On an average,it is assumed that 40-50% of your salary will be available for repayment. However reimbursements or allowances are not considered for this. Also, if you have other liabilities like another existing loan,this may bring down your eligibility for a home loan. Some banks even consider the number of dependants you have. Higher number of dependants implies lower repayment capacity.

The maximum amount you’re eligible for: More than often, you’ll be expected to pay about 10-20% of the purchase price of your home or apartment or villa that you want to buy as down payment to the lender. The rest of the amounts including the registration, transfer and stamp duty charges are financed by the lender. It is always better to pay maximum amount as down payment to keep the interest cost minimal.

Know your loan type: There are 2 types of home loans based on the interest rate. One is a fixed interest rate loan and the other is a floating rate loan. As the name suggests in the fixed one, the interest rate doesn’t change with market fluctuations. Floating interest loan, on the other hand, varies according to the market conditions. Though fixed interest loans may seem attractive at first, its fixed nature might seem to be a bit of a disadvantage, especially with long term loans like home loans, where the interest rates are bound to come down after a period of time. Therefore, floating interest loans might be a better idea unless the economy is sure to show an increase in interest rates in the near future.

The role of a co-applicant: It’s absolutely compulsory to have a co-applicant while applying for a home loan. If you have a co-owner for the property, then he/ she must be the co-applicant for the loan unless in circumstances when you’re the sole owner, your immediate family member must stand as a co-applicant. Co-applicant cannot be minors but should not be above a certain age as well.

Required documents: It is essential to make a check-list of the required documents for the application of a home loan.Though it may vary from bank to bank, you’ll mostly have to submit your identity and address proof,most recent salary slip, bank statements from the last 6 months and sometimes even collateral security like the assignment of life insurance policies, pledge of shares, national savings certificates,mutual fund units, bank deposits or other investments.

Don’t forget to negotiate! No matter which type of home loan you finally choose, it is important to negotiate the loan amount and interest rate with the bank. Though the bank may always take the final call, if you’re a trustworthy, long term customer of the bank with a clean credit history, make sure you negotiate well enough to get good rates.

Sanctioning and disbursement of the loan: Once the bank decides to sanction the loan after checking the submitted documents, the bank will give you a sanction letter along with the loan amount, tenure, interest rate and other terms regarding the home loan. When the loan is handed over to you, it is called the disbursement of the loan. During this stage you will have to submit an allotment letter, photocopies of title deed and encumbrance certificate. The loan can be disbursed in full or in 3 in stalments.

What is MCLR? The marginal cost of funds based lending rate (MCLR) is a new method of bank lending wherein the banks have to review and declare over night, 1 month, 3 months, 6 months , 1 year, 2 year , 3 year MCLR rates for each month. For most MCLR linked home contracts, the banks reset the interest rate after 12 months. In the MCLR system, there’s always the risk of any upward movement before your each the reset period.

What is a base rate? All loans sanctioned in India and credit limits renewed after July 1, 2010 and before April 1 2016 are priced with reference to a base rate. There is always just one base rate for each bank. Banks use this to calculate the cost of funds either on the basis of average cost or on marginal cost of funds.

Repaying the lender: The lender usually allows you to choose from various modes of repayment which includes ECS(Electronic Clearing System), direct deduction of monthly in stalments from your salaary or by issuing

Pre-payment of home loan: If you make any further payment towards the loan apart from the regular EMIs, that’s called pre-payment of the loan. It directly reduces the outstanding principal amount and the interest gets calculated based on the reduced principal.

Insurance against home loan Though it isn’t mandatory to buy an insurance plan while taking a home loan, it’s always a good idea to cover your home loan liability and not let it fall on your family, in your absence.

Tax benefits on home loans: Of the total annual EMIs, the principal amount gets tax benefit under section 80C of the total Income Tax Act. The partial pre-payment amount also qualifies for the same, but within the overall limit of Rs.1.5 lakh under section 80C. In the case of a self-occupied property, the interest paid is deductible up to Rs. 2 lakh in a year.

You can always switch lenders: Once you’ve taken a loan from a lender, it doesn’t mean you’re completely stuck with the entity.You have all the freedom to switch in case you get a better deal from another lender. A processing fee is the only additional cost you have to bear.Signing up for a home loan is a long term commitment and requires maximum effort from your end.So make sure while you choose to take a home loan for buying a property, villa or apartment of your choice, you invest in a trust worthy builder who is sure to deliver projects on time at exceptional quality.