A home is a milestone in life for everyone, be it a humble cottage or a sprawling mansion. Real estate is one of the prime businesses today and buying property is easier than ever these days. Kerala is currently a hotspot for properties with both residential and commercial spaces in huge demand. Kochi, Trivandrum and Kozhikode are high-value areas due to higher population, propelling property prices through the roof. The state, flaunting the tag of excellent facilities in education, healthcare and soaring job prospects has turned to be a haven for the younger working population. Our pristine landscapes and low pollution levels are also attractions for settlement in the state.

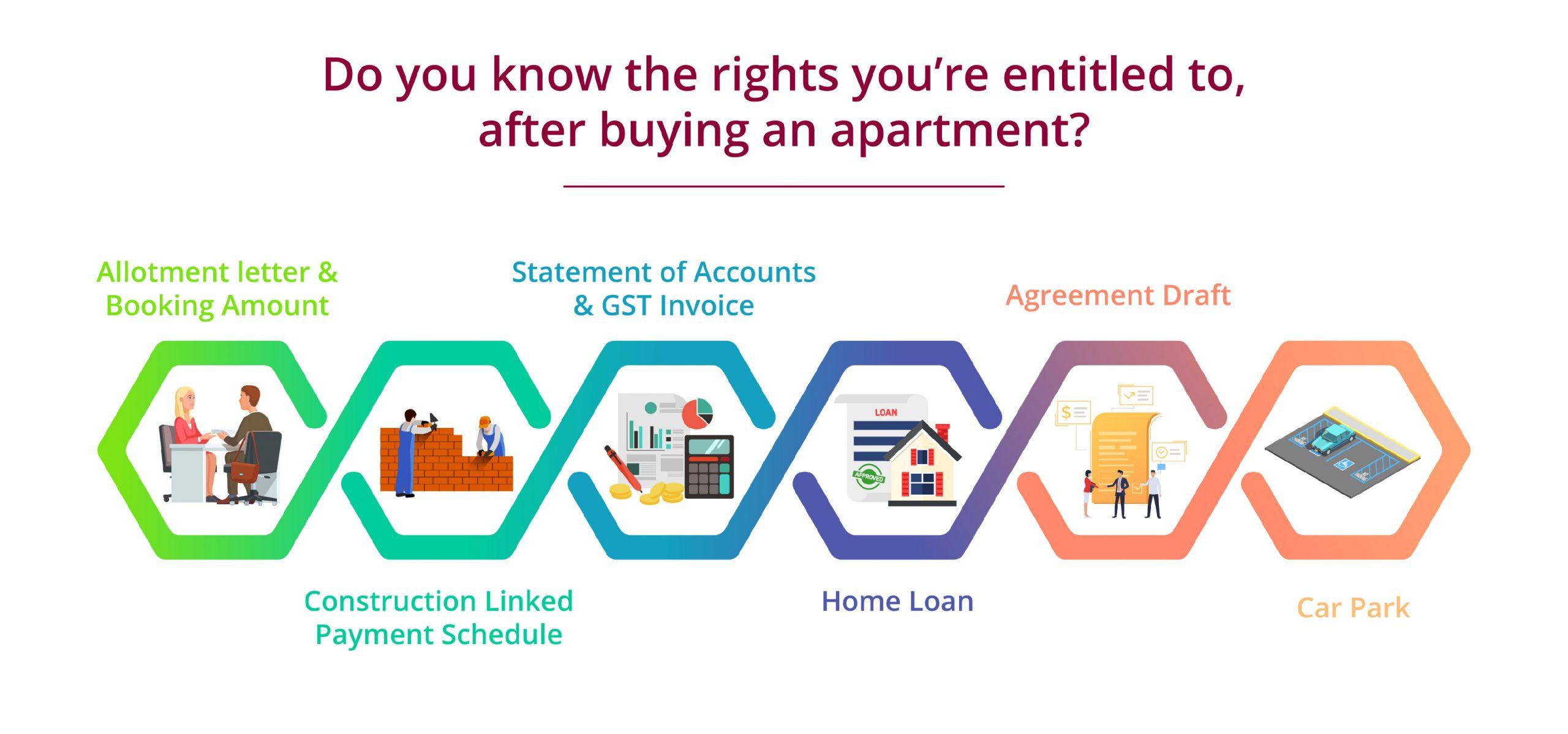

With the massive boom in the real estate sector, the choices in properties are many, but one must be cautious about property transactions and their transparency and credibility. When buying property, there are certain documents to be cleared which ensures your ownership of the property as well as releases any dues that are already related to it. Paperwork is pretty much the same across the country with a few regional differences here and there.

Choose the right property:

The first step is to single out your favorite property. You can seek the help of developers, real estate agents or even online websites that are aplenty, to know the details of the property, land and locality as well. You need to make sure that the property that appeals to you isn’t caught up in legal issues or disputed, as this can make things complicated and may even cost you on your investment.

Seek Legal advice:

It is always recommended to consult an advocate specializing in Kerala real estate legal scenario so that you know the paperwork required and risks involved if any.

Encumbrance Certificate:

An encumbrance certificate is one that helps you verify whether the immovable property you plan to buy is free from claims such as loans, leases, unpaid debts, etc. You can obtain one by submitting the relevant documents at the Sub-Registrar’s office.

Mutation Records:

The transfer of title of the property from one person to another is called property mutation. The municipal office handles this, and this procedure is mandatory for payment of taxes. You need to submit the relevant documents along with an application in plain paper and a non-judicial stamp of specific value to the Tehsildar of the area where your property resides.

The Agreement:

An agreement, as it sounds, is a legal contract written between the buyer and the seller in the presence of witnesses. It should state the fact that you are willing to buy the property from the seller and the seller is willing to sell it to you. The document will also specify terms and conditions like the property value, possession details, property extension, early or advance payment required, etc. Both the parties are bound to abide by the agreement and defaulting on this gives rise to a legal penalty.

Stamp Duty:

The registration of the sale agreement is with the respective Sub-Registrar’s office in the area. Kerala’s Registration Department is one of the busiest departments generating a lump sum of the state revenue, putting it at the third largest source of money in the State’s treasury. The procedure requires you to pay stamp duty and registration fees. For the former, you are required to buy stamp paper from the State Treasury in your name. The price of the property determines the stamp value.

Generally, in Kerala, the stamp duty stands at 8% and the registration fee is 2%.

For the particular case of family properties, an amount of Rs. 1,000 is fixed for all transactions. Family property partition and gifting of land to immediate family members does not incur any charges.

Fair Value of the property:

Stamp duty rate depends on the price of the property. One has to keep in mind that the sale value of the property cannot be lower than the fair value of the land stipulated by the government. The government fixes the fair value of the property and the value is revised from time to time, as per the budget.

The Sale Deed:

You need to acquire a sale deed drafted by a professional, that includes all details of the transaction. Care must be taken to ensure that it is error-free.

Registering the land:

‘Section 17’ of the Registration Act, 1908 is the guideline for all land registration process in the country. Sale of any immovable property has to be registered to ensure the owner gets a clean title on the property. It should be noted that the registration charge is 2% for all types of property in Kerala and it is done at the Sub Registrar’s office. It is important to note that the registration process should be completed in the time frame quoted in the agreement. There are a couple of auxiliary fees that you will have to pay during these transactions, which include documentation fee, fees for realtors/brokers etc.

Secure all documents:

When the registration process is done with, you get a receipt of the same. It is an important document and will come to use when you are planning to sell the land in the future, or for any reference regarding the transaction. Be sure to file and keep all the records of your property carefully.

Changing the title of the property:

The title deed puts your name on the property after you have bought it. You will have to submit all relevant documents required for the same at the municipal or corporation office along with an application by which they will alter the name from the previous owner to yours in the revenue records.

Property tax payment:

Once you have gained authority over the property, you can pay the property tax in your name.

An insight into the procedures gives you an upper hand when you proceed to buy the property you seek, and also saves you from too many back and forth trips in getting the papers in order. When making significant investments, you should consult a professional regarding the queries you may have and should get your doubts cleared, or you may get exploited.