The growth of a particular industry is influenced by several factors. Government initiatives, policies and interventions, to market conditions, socio- economic changes, political events, etc. are some of the many factors that influence the growth of a given industry. It’s also true that every industry’s growth directly impacts the development of a country. As India completes seven glorious decades of independence, one of the industries that have had a significant impact on shaping its path to development, has undoubtedly been the real estate industry.

Over the decades, we have seen the real estate industry in India shape itself into the giant it is today and it is worthwhile to peep into some of the major real estate milestones of our country.

Formation of the new capital cities: The years 1952 and 1960 witnessed the formation of the new capital cities of Chandigarh and Gandhi nagar. This was the first time new cities we re entirely planned in the country.

The first city development plan: In 1966, the Maharashtra Regional and Town Planning Act first incorporated the practice of development plans and town planning. The first guidelines for district planning which was issued in 1969 led many states to formulate district plans. Except for some great examples, this initiative didn’t result in many positive results.

Urban Land Ceiling Act: To control speculative hikes in land prices in urban areas and to provide low-income housing, the Urban Land (Ceiling and Regulation) Act was enacted in 1976. Due to its poor implementation, it worsened the situation of land availability for social housing and social infrastructure in urban areas and got abolished in all states except in West Bengal and Kerala.

Formation of government institutions: Institutions like the Housing and Urban Development Company was set up in 1970, the Mumbai Metropolitan Region Development Authority was setup in 1975, the National Housing Bank in 1988, and the Housing Development Finance Corporation in 1994 were all institutions formed by the government to strengthen the real estate industry.

Liberalization of the economy: While the nation was undergoing a threatening fiscal deficit crisis, the economy was liberalized in 1991 through reforms, which led to its process of modernization. This resulted in the opening of many more job opportunities and gave a huge section of the consumers, access to many products and services for the first time ever. With this,many multi-national companies made their entry into the Indian economy.

India’s first property cycle: The market which was opened up after liberalization, witnessed property prices go up for the first time ever, which marked the completion of India’s first property cycle from 1994-1999. But the realty market came down due to inherent inefficiencies after 1995. The foreign capital got completely wiped out and the growth in capital values came to a halt together with the advent of the Asian Financial crisis in 1997-1998.

Commercial is ation of airspace: The commercialization of airspace above transit routes was first introduced at Vashi station in 1992. Other stations like Sanpada, Juinagar, Nerul and CBD Belapur which are all on the same railway line, followed Vashi’s footsteps but wasn’t very successful. However, the most recent transformation of Sea woods-Darave railway station in2017 was exceptionally successful.

India’s growth in the software world: India’s self-discovery as a major player in the global software market was led by the Y2K bug which was a major turning point for the real estate industry as well. More foreign companies started setting up offices in cities like Hyderabad and Bengaluru which resulted in the commercial and real estate growth of these cities.

FDI in real estate: Foreign direct investment in real estate was first allowed in 2005 and this opened up newer ways for funding. This resulted in the growth of the industry in terms of business practices and product offerings. In the recent years, the FDI regime was further liberalized and this has led to private equity inflows and the entry of many foreign developers.

The coming of the malls: Just before the arrival of the millennium, Indians got introduced to the concept of organized retail through India’s first mall – Spencer Plaza in Chennai which was soon followed by Crossword in Mumbai and A nsal Plaza in Delhi. And ever since then, there have been shopping malls budding all across the country and there’s been no looking back.

Modern is ation of airports: With the public-private partnership model in 2006, the government restructured and modernized the brownfield airports such as Mumbai and Delhi and also the Greenfield airports at Bangalore and Hyderabad. This introduced the concept of airport cities and airport precinct real estate.

The collapse of Lehman Brothers: 2008 witnessed a terrifying panic with the collapse of Lehman Brothers, along with sub-prime crisis leading the investors to inspect the rationality in investments across asset classes. The consequential economic slowdown and risk of job losses made it hard for investors to exit from their stakes in Indian real estate. The impact of the global financial had a big impact on the commercial realty in India and a limited impact on residential realty in the country.

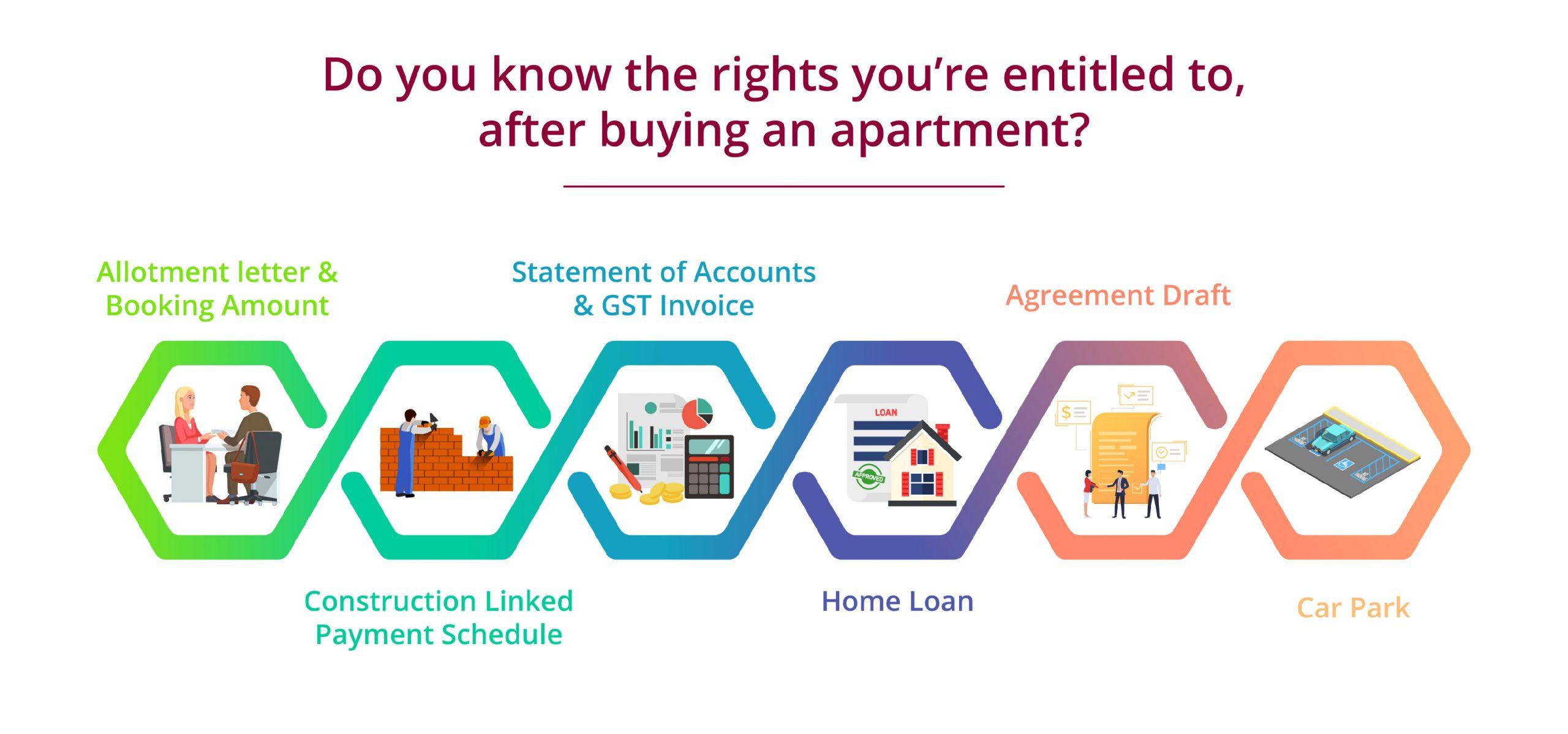

RERA: The Real Estate Regulation and Development Act came into effect from May 1, 2017, to en sure that home buyers are not taken for a ride by unscrupulous developers. This landmark Act will make home buyers confident, empowered with information and well-protected and make the non-serious players disappear from the highly-fragmented residential real estate industry.

REIT: The Real Estate Investment Trusts were first opened up in 2014 and the first REIT is due for launch soon and would allow small-ticket investments in commercial real estate of the country.Given the expanding universe of Grade-A office properties in Indian cities as well as rising rentals across their micro-markets, REITs offer an attractive way to investors to trade in prime commercial real estate.